اُردو ميں ويڈيو ديکھيں

Are you looking for Income tax filing FBR (Problems & Solutions) ? If yes, then you are on the right place.

This guide will help you out in the problem of tax filing.

Therefore it is requested that you should read this guide to the end.

FBR is the department of Inland revenue or internal revenue that means the department which collects taxes within the state.

This guide on income tax return filing FBR includes;

• Overview of Income Tax Filing Guide

• Purpose of Income Tax Guide

• Who Can Benefit From This Guide?

• Important Things You Need Before Income Tax Return

Filing

• Step-by-Step Method of Filing Income Tax Return

• How to View and Print Old Declarations of Income Tax

Return

• The Method to Add Your Personal Assets/Liabilities

• How to Calculate Your Income Tax Rebate With Example

• Frequently Asked Questions (FAQs

• The Final Words

Overview of Income Tax Filing Guide

This is the updated guide from the year 2020 on income tax return filing online for FBR.

We have given here the comprehensive details on how to file returns so that once after going through this guide you should not be in need of anyone else to file tax return for you.

Filing tax every year is the big problem for the majority of the people in Pakistan.

Nearly 70% of the people are unaware of the fact that they can submit income tax return on their own, without the help of anyone.

Most of the people file their returns with the help of clerks, officials of Federal Board of Revenue (FBR) or lawyers.

That definitely means they have to pay a certain amount

for this service.

We have observed many people, upon forgetting their passwords or PIN

codes, call the concerned persons for help.

Because at the time of registration they usually don’t provide their own email address and phone number, which is of the ones who serve the purpose of tax filing for them.

Purpose of Tax Filing Guide

The only purpose of this guide is to give general awareness to the tax payers of Pakistan that tax filing is not a difficult job at all that one should require the services of someone to get it done for him.

Therefore our purpose is crystal clear that we just want to help people.

We want they should do their income tax filing themselves.

This shall resolve their worries of every year.

We have made no stone unturned in order to make you understand what is the filing of income tax and after reading this page you shall be confident and with the clarity of mind you will make an attempt yourself.

Of course the same were you intentions behind visiting this page.

Although everything on the FBR iris website is self explanatory, but still at the beginning you may have some difficulties, but with the passage of time you will get over it.

Remember little-by-little every problem gets resolved.

And if you have no escape from income tax filing why not to learn it so that you should not keep waiting for someone to help you out.

You just have to focus your mind on this step-by-step guide.

Now let’s get started

Who Can Benefit From This Guide?

As we have already mentioned that this guide tells how to file income tax return in Pakistan.

This guide is therefore equally applicable to the following;

1. Income tax filing for salaried employees

2. filing tax returns for business class

Important Things You Need Before Income Tax Filing

When you are filing tax return the question is what are you telling FBR?

Of course it is the total account of your earning, assets, expenditures and liabilities.

Therefore before filing your income tax return online you must have all the record which gives details of your earning, assets, expenditures and liabilities.

You cannot file your return if any of the following things is missing.

Things Needed Are:

1. Accounts office statement/Annual statement with the exact figures of total gross salary and tax deducted. If you are doing business you must have the complete record of all the earnings in the fiscal year from 1st July, 2019 to 30th June, 2020.

2. Salaried persons should have entire record of any amount other than salary received in the fiscal year. Government servants receive some additional allowances, teachers received additional money by marking papers etc. So whatever is the case you must have a complete record of it.

3. Exact figures of expenditures during the fiscal year.

4. Proof of “withholding tax” you have paid during the fiscal year in case you are going to claim for refund.

5. Exact account of your wealth and assets (movable and immovable property etc)

Warning: remember you must NOT hide anything from FBR in your income tax return filing. All the information and figures should be exact. Please double check everything before hitting the submit button, because it is all your responsibility.

In some particular cases you are required to give some additional information.

So make sure you must have all the supporting and additional documents and figures (if need be).

Once you have everything aforementioned now you can sit before your computer or laptop and do as guided below.

If your earning now meets the tax slab and you have registered yourself in

FBR please visit our FBR registration simple step-by-step method page.

Watch Urdu Video on Income Tax Filing

Step-by-Step Method of Filing Income Tax Return

Previously we had to submit income tax return and statement of assets separately.

But from the year 2019 onwards FBR has included both under one declaration.

So now it is quite easy that you need not to submit

two declarations.

It will be only one.

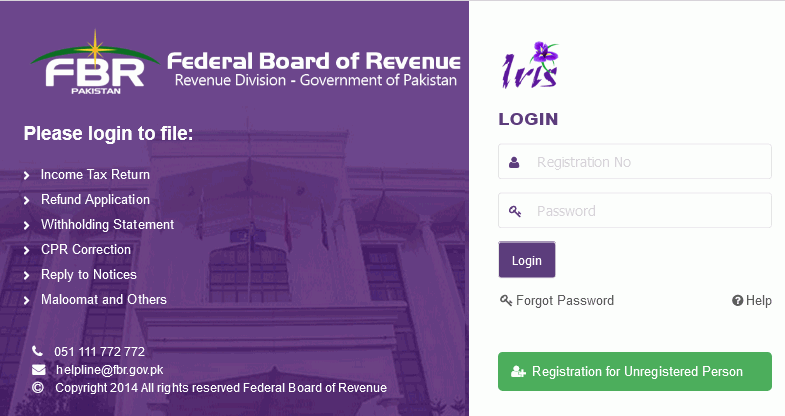

Log in To FBR Iris Website

Click on FBR iris

Give your CNIC as “Registration No” and password in order to login to FBR Iris website.

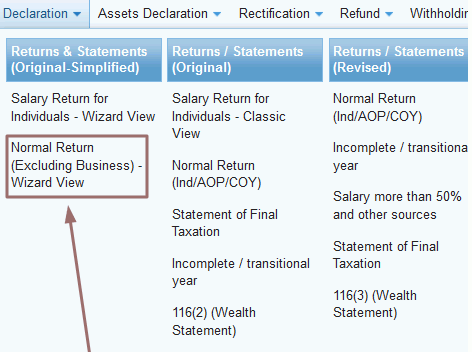

Click on “Declaration” (Top left menu) and select “Normal Return (Excluding Business) – Wizard View”.

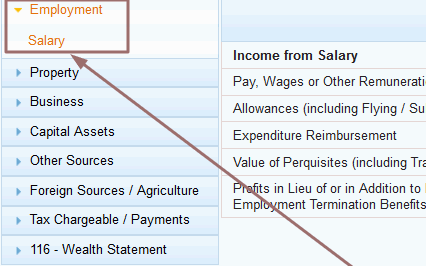

Go to left menu and click on “Employment” then select “Salary” from the dropdown menu

Remember, once you open FBR iris portal it shows you your last year’s entries. You just need to edit them.

This helps a lot that you need not to open your last year income tax declaration.

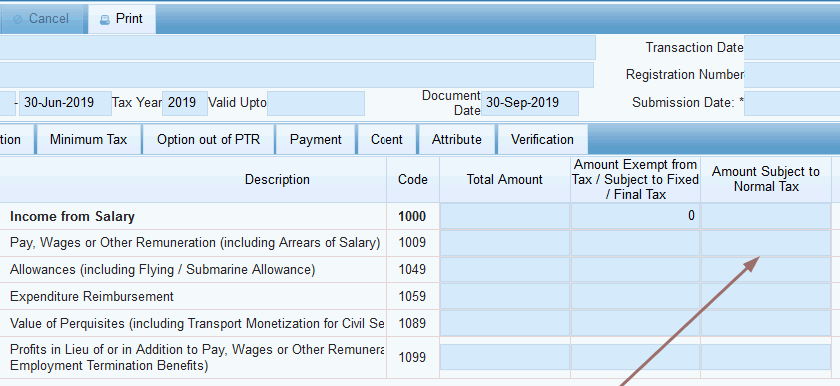

Go to the row of “Pay, Wages or Other Remuneration (including Arrears of Salary)” and give the total amount of your annual salary in “Amount Subject to Normal Tax” column and click on “Calculate” button (top right).

Remember when you click on “Calculate” button FBR iris portal calculate that amount and adjust figures according to the amount you have entered.

So be careful if you see there is no such change on the screen you must click on Calculate” button again so that it adjusts the figures according to the amount you have entered.

Give Details of Income Tax

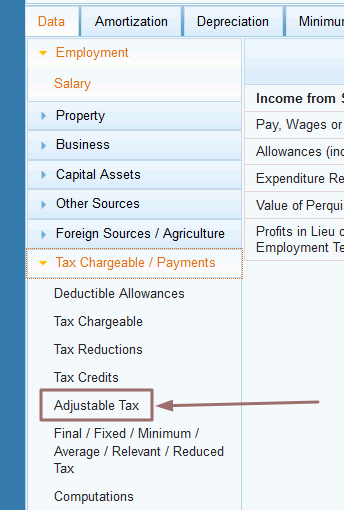

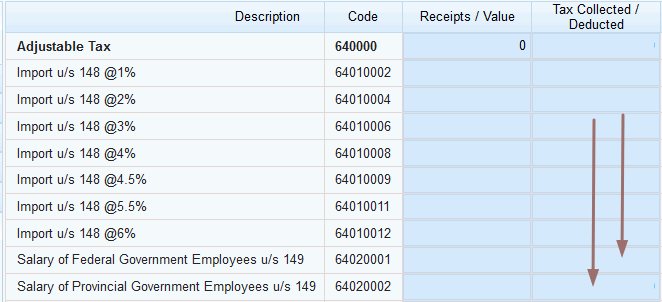

Now go to “Tax Chargeable/Payments” from left menu and click on “Adjustable Tax”.

Federal employee should go to “Salary of Federal Government Employees u/s 149” and if you are provincial employee go to “Salary of Provincial Government Employees u/s 149” and in the column of “Tax Collected / Deducted” enter the amount of total tax deducted from your annual pay as shown in your Accounts office statement.

After entering the figures click on “Calculate” button (twice, if need be, as explained earlier).

It may be that the figure is given there already, because when you click on “Calculate” button it calculates the tax and gives the figure in the appropriate column and row automatically.

How to Enter Tax Rebate in Income Tax Filing

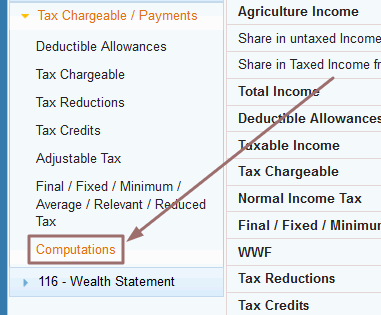

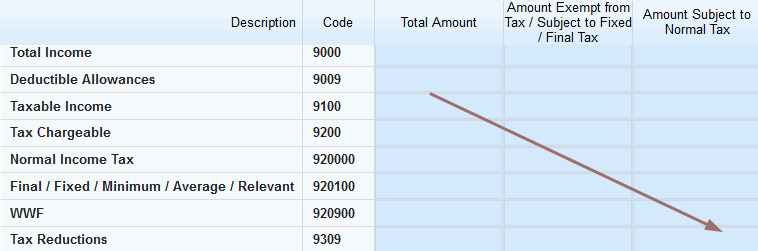

If you have tax rebate then go to “Computations” from the left menu under “Tax Chargeable/Payments”.

Now go to the row of “Tax Reductions” and give the rebate amount in the column “Amount Subject to Normal Tax” and click on “Calculate” button.

Note: Usually rebate is 40% for full time teaching staff. If your annual tax is Rs. 100,000 it means your rebate amount is Rs. 40,000.

Make sure in the column of “Tax Chargeable” there should be the amount of total tax deducted from your salary that is shown in your Accounts office statement.

How to Fill in Wealth Statement Form

Wealth statement has three sections; personal expenses, personal assets / liabilities and reconciliation of net assets.

1. Personal Expenses

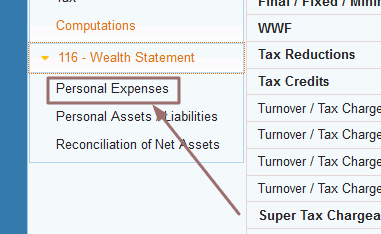

Once you have done all the above successfully now go to “116 – Wealth Statement” and click on “Personal Expenses”.

Give the figures of your yearly expenses against the heads mentioned on the page.

If you have some other expenses include them in “Other Personal/Household Expenses”.

In case you are helped by any family member in your expenses you can add it in “Contribution in Expenses by Family Members”.

2. Personal Assets/Liabilities

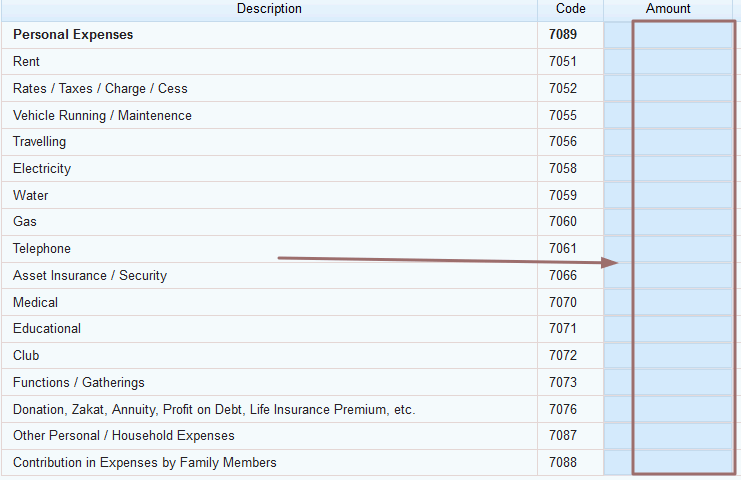

Now click on “Personal Assets/Liabilities” and add the details of your assets and liabilities.

You have to mention here detailed information of your assets. For more information see How to add your personal assets / liabilities

3. Reconciliation of Net Assets

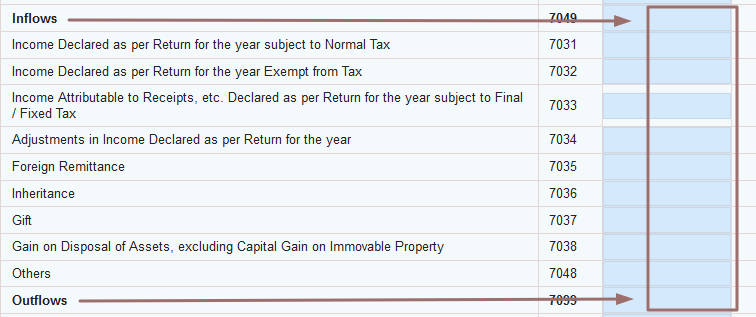

Now click on “Reconciliation of Net Assets”.

Add the total amount of your earning of the fiscal year in the column of “Amount” in the row “Inflows”.

Note: Remember, “Inflows” is total money you earned in fiscal year and “Outflows” is the total expenditure of the fiscal year. Since you have already given your total expenses therefore in outflows the figure is already entered which is your total expens.

Important: Please double check everything. Every entry should be error free and nothing should be missed.

Once you are satisfied with all respects now you can submit your return.

And once it is submitted it can no longer be edited. So make sure everything is accurate to the best of your satisfaction and knowledge.

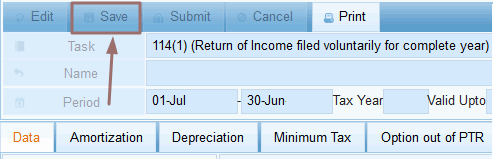

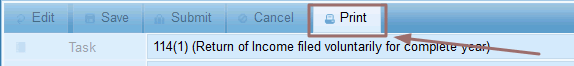

Income Tax: Save, Verification, Submit & Print

Once you have completed click on “Save”.

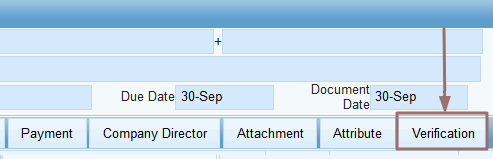

After that “Verification” button on the top menu bar.

Once you click on “Verification” you will be asked to give pin code. Give your pin code.

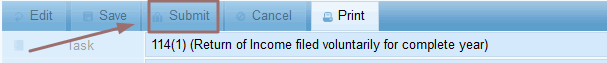

After giving you pin code click on “Submit” button in the top menu bar.

Your income tax return is now submitted successfully. Click on “Print” in the top menu bar and get the print copy of your income tax return for your personal record.

Now you have successfully filed your income tax return and you can come out of this window by clicking on the cross button at the top right of the window.

Now click on “Logout” (the top right option) and you will come out of FBR iris portal.

Note: FBR iris keeps on introducing little changes on the portal. This is the latest method but in coming times you may see slight changes in look and feel of the site but the general concept remains all the same.

How to View and Print Old Declarations of Income Tax Return

Once you have submitted and printed the copy of your income tax return of this year it remains saved in your account on the FBR Iris website.

And you can view and print your income tax return submission of any year whenever you want.

The following is the simple method.

1. If you want to see your tax submitted file of any

year you just have to login to the FBR iris website, click on “Completed

tasks” (left menu) and then “Declarations” under it.

2. It shall give you the complete list of your already filed income

tax return files. If you click any of them the row shall be selected.

3. Now click on “View” button at the top bar.

4. Now the particular tax declaration is opened before you. You can

print it for your record.

In fact when you click on print button it saves the PDF file in your computer which can later be printed.

So in this way you can also keep the soft copy of your tax return in your computer or laptop.

The Method to Add Your Personal Assets/Liabilities

In “Personal Assets/Liabilities” under “116 – Wealth Statement” you have to add your assets.

It is the crucial part of wealth statement and you have to be extra careful in filling in this portion of tax return.

Here we shall guide you how to add your assets.

When you will open “Personal Assets/Liabilities” it is self explanatory.

It clearly tells you what to add.

You will have to give all the applicable details of property for example; land, business capital, equipment, animal, investment, vehicle, precious passion etc.

How to Enter Details of Property

Now if you want to enter the details of your property

you simply have to go to the appropriate row and click on the plus

button in the column “Action”.

Now you will see it is easy to give your details.

You will have to give the details of area, cost, address etc and it shall be saved in the iris system.

In case of motor vehicle you have to give the registration number, make or modal etc.

If you have any precious possessions you will give its complete detail like jewelry, its weight and cost etc. Give information as applicable to you.

In case of any asset that is other than the available options then go to “Any other assets” and put entire information there.

How to Add GP Fund

If you have amount like GP fund drawn you have to add the figure of that amount in “Credit (Non-business) (advance / borrowing / credit / deposit / loan / mortgage / overdraft / payable)”.

Please give complete detail in that the amount falls in which category and what is its status. Like, loan is the category and GPF its status that you have to return back in installments.

Remember you should not give the total GPF amount here but the amount that was outstanding up to 30th June this year (the end of fiscal year).

In the description of GP fund you should write the complete amount that you have received.

For that purpose go to “Any other asset” and you can write like “Withdrawl of GP fund advance Rs. ______ in tax year 2019”

(Note: It is just an example you have to write as applicable and appropriate in your case) and in the column where you put your figure you have to put “0” because you got this money as asset but it is loan and you have to return it back.

Its details shall be entered in “Credit (Non-business) (advance / borrowing / credit / deposit / loan / mortgage / overdraft / payable)” as explained earlier.

When you enter the cost of your plot (land) you have to enter the cost in which you have purchased.

And when you sell the property at that time your figure should be the sale price.

Warning: Remember many times people give wrong figure unintentionally. One extra zero may cost you so be extra careful in filling in your income tax return, and double check everything.

How to Calculate Your Income Tax Rebate With Example

Rebate means tax reduction, that how much relaxation / deduction FBR gives you in the payment of your income tax.

Many times people are unaware about their tax rebate.

Full-time teaching staff has 40% rebate.

Here we shall tell you the method that we generally use in order to see tax rebate.

This method works for salaried class.

Once you give the figure of total salary under “Employment” menu and click on “Calculate” button. It calculates your total tax automatically.

Now go to “Adjustable Tax” under “Tax Chargeable/Payments” from left menu and see what figure FBR iris system has given as the total tax on your salary.

Now open Accounts office statement / Annual statement of salary and see the exact figure of income tax you have paid in the fiscal year.

Minus this figure from the total tax shown on FBR iris

website.

The rest is rebate.

Example of Rebate

For example if FBR iris website calculates your total chargeable tax as Rs.100,000 and your Accounts office salary statement shows Rs.60,000 tax paid in the fiscal year.

It means the rest of Rs. 40,000 or 40% is your tax rebate.

Frequently Asked Questions (FAQs)

How do I file a tax return for FBR?

Go to the detailed step-by-step method on income tax filing. Adopt the procedure and you could do that. Remember, you have to look for anything additional that relates to your case.

Since tax filers cases vary and it was not possible, on one page, we could include various different situations.

This is the simple stepwise guide that focus on basics that everyone should know. You should also take legal help from your lawyer if applicable.

What is the last date of filing income tax return in Pakistan?

Income tax filing starts from September every year. The last date of tax filing is not definite. FBR keeps on increasing and you can still file your tax return at the last day of February.

FBR is the final concerned authority in tax matters and they may change the schedule. Anyway you can find the last date from the official website of Federal Board of Revenue.

Who must file an income tax return?

Any person whose earning in the fiscal year meets the tax threshold must file income tax return. Remember the tax slab varies in different governments. You must follow the recent tax threshold issued by the current government.

How do I find my FBR income tax return?

You can find your old declarations in the “Declarations” tab when you login to FBR iris portal. The detail, in this connection is mentioned on this page under “How to view and print old declarations of income tax return”.

How do I claim my FBR income tax refund?

In order to claim your FBR income tax refund you have to visit your Regional Tax Office (RTO) and give application as prescribed by them.

How can a salaried employee file income tax return in Pakistan?

The above step-by-step guide for income tax filing is also for the salaried employees.

When I am declared filer?

You are not declared filer at the time you submit your income tax return. FBR releases the list of filers on 1st March every year.

If you have filed your first return in 2020 your name shall include in filers’ list on 1st March 2021. Meanwhile if you have to produce any proof of your tax filing you can present the print copy of your tax return.

The Final Words

Remember, income tax filing is not a job that you cannot do entirely. Just give it a try.

The above guide shall be very helpful for you.

It’s better to keep your affairs regular by handling them yourself.

Remember, this guide is for the simple cases and if you have some additional implications in your income tax filing matter then you must seek legal advice from your lawyer.

Warnings: Tax filing is the sensitive matter. NEVER hide anything in your returns. Always double check everything before submission.

Otherwise you may be in a serious trouble. It is therefore advised that you must keep every record of your earnings, bank accounts and assets and liabilities before you start filing process. This guide DOES NOT cover everything nor do we give any legal advice.

Therefore we don’t bear any responsibility in your income tax filing matters. Read disclaimer.

Disclaimer

Bslearning.com is not the official website of FBR. This site therefore bears no responsibility of your income tax filing or any issue concerned with it. We do not give any legal advice in tax matters. Our job is to give general information to public and help them out by providing useful information.

Since every person on tax slab is concerned with filing income tax return, so we have collected and studied all the relevant information to make this page really useful for the concerned people.

Remember we have given WARNINGS and NOTES on this page that you SHOULD NOT HIDE ANYTHING while filing your tax return, be extra careful and double check everything before submission of tax return. Don’t take it casually it is a very sensitive matter. Remember the general information on this page is not applicable in every case.

- FBR Registration and Income Tax Return

- Income tax finling FBR [Step-by-step Guide from A to Z]

- NTN verification FBR

- Income tax calculator FBR

- Income tax calculator FBR for business class

- Create PSID and make payment

- NTN Registration & Verification

- Normal return & Salary Return difference

- FBR: Weath statement problems & solutions

- How to receive salary slip on email every month

- How to see your filer status in ATL

- Income tax slabs explained for financial year 2022-23